Overview

To process billing to account holders you first need to set up the ‘account’. An ‘account’ is the basis for a tax invoice therefore the choice of account holders directly affects the invoices that will be produced.

Please find some examples following which will illustrate the decisions that must be made in order to successfully set up accounts.

Example 1.

Q: If the local hospital has an account does all work for the hospital get included on a single invoice or should there be a separate invoice for each department (cost centre)?

A: If multiple invoices are required then an ‘account’ will need to be set up for each one.

Example 2.

Q: In the case of a school run, the invoicing should record which students were picked up? How is this work to be billed in a way that will show this?

A: There are a couple of answers to this, 1. Have one invoice/account for each ‘run’ . 2. One invoice / account for each student.

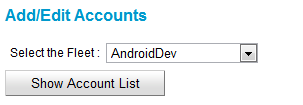

Account List

To display the current list of account so that they can be viewed, added to or modified you first need to select the applicable fleet.

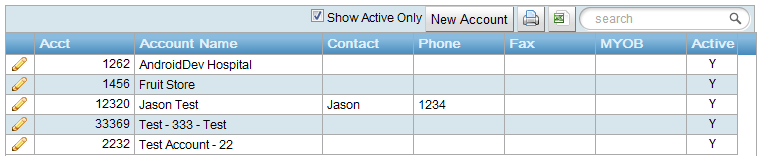

Once the fleet is selected the “Show Account List” button should be pressed. This will display all of the current active accounts for the fleet in a table that shows a summary of the information about an account.

Deactivated accounts can be displayed by un-checking the “Show Active Only” checkbox

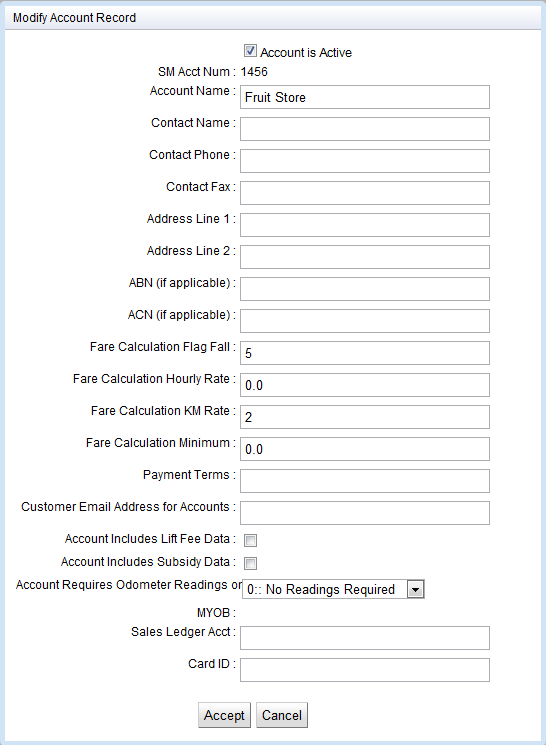

Adding or Editing Accounts

If the “New Account” button is pressed or the ![]() button is pressed a dialogue containing all of the information on an account is displayed. To save any changes made select the “Accept” button, otherwise select “Cancel”.

button is pressed a dialogue containing all of the information on an account is displayed. To save any changes made select the “Accept” button, otherwise select “Cancel”.

For each account, you will need to complete the following information:

| Field | Data |

| Customer account number | The customer number must be unique. Any number may be entered.

Two extra ‘check digits’ are added to the SM account number and the new number is used as the account number in the system. These extra digits form part of the account number and are used to catch data entry errors. |

| Account name | This is the account name that will appear on the tax invoice. If invoicing totals are being transferred to MYOB the name entered here must be exactly the same as the name in the corresponding MYOB card.

This name appears on the printed invoice as the addressee so should be a readable name. If necessary change the MYOB card name so that the names match. |

| Contact name | This name normally appears on the tax invoice after the word ‘Attention:’ |

| Contact phone | This number normally appears on the tax invoice after the contact name. |

| Contact fax | This number normally appears on the phone after the word ‘fax:’ |

| Address Line 1

Address Line 2 |

Address to be printed on the tax invoice. |

| ABN | Australian Business Number to be printed on the tax invoice. May be found at the website www.abr.business.gov.au |

| ACN | Australian Company Number to be printed on the tax invoice. May be found at the website www.abr.business.gov.au |

| Payment terms | This can be printed on the invoice if the fleet invoice format requires it |

| Fare calculate Flag Fall | This is an optional field that allows for a different flag fall than the fleet default for this account. This is used in the fare estimation in the dispatch client and express booker if this account is chosen. |

| Fare Calculation KM Rate | This is an optional field that allows for a different per kilometre rate than the fleet default for this account. This is used in the fare estimation in the dispatch client and express booker if this account is chosen. |

| Fare Calculation Minimum | This is an optional field that allows for a different fare minimum than the fleet default for this account. This is used in the fare estimation in the dispatch client and express booker if this account is chosen. |

| Fare Calculation Hourly Rate | This is an optional field that allows for a different hourly rate than the fleet default for this account. This is used in the fare estimation in the dispatch client and express booker if this account is chosen. |

| Customer Email address for accounts | E-mail address to be used if invoice can be sent by e-mail. |

| Account Includes Lift Fee Data | This field should be ticked if the account should include lift-fee claims. These are entered in the subsidy section of the fare payment screen. Normally only one account has this field ticked. |

| Account Includes Subsidy Data | This field should be ticked if the account should list subsidy claims. These are entered in the subsidy section of the fare payment screen. Normally only one account has this field ticked. |

| Account requires Odometer Readings | Select this if the account requires odometer readings for each of their bookings. This will show the readings taking in the vehicle in the invoice for this account. |

| For MYOB (Quicken fleet property set to blank) | |

| Sales Ledger Acct | MYOB account to be used for recording ‘sales’ to account holders. One entry will appear for each batch of invoices generated. Normally this number will start with 4 and often the same MYOB account number is used for all work. |

| Card ID | MYOB card number to be used for recording ‘sales’ to account holders. One entry will appear for each invoice generated. Note that the name given in the account name field above must be exactly the same as the name in the MYOB card. |